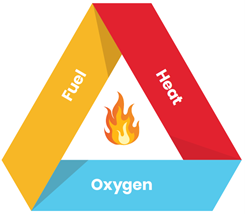

One of the first concepts taught to new firefighters is the Fire Triangle – the recipe for the chemical reaction that has to occur in order for fire to break out. It’s normally used as a basic form of fire safety training, teaching potential firefighters to identify the most dangerous elements of their working environment.

The triangle consists of three elements: fuel, heat, and oxygen. If fuel can be heated to the point at which it combusts, and oxygen is then able to sustain the flames, you’ve got a fire on your hands. And if you want to prevent a fire, you have to remove one at least one element of the equation:

For our purposes, it’s an apt analogy for the seemingly innocent tasks that can wreak internal havoc in financial organisations if left unchecked. Trivialities like building a project tracker in a spreadsheet, or collecting financial forecasts over email, spiral into a magma of insecure, inconsistent processes.

As these stack up, they threaten your ability to properly monitor how departments – or even the entire organisation, given time – is operating. While they’re convenient for individuals in their daily routine, they represent a serious unchecked fire hazard for the organisation at large.

So: what are the elements of the fire triangle for financial service organisations.

1. The fuel: non-scaling processes

These short-term solutions, usually set up to manage projects through, have a habit of outlasting their intended shelf life. Unscalable, unregistered, and unintegrated into wider business systems, they lurk in inboxes and shared file storage, largely unrecognised by the majority of the organisation.

2. The oxygen: the business environment

Such processes exist because they’re a convenient quick fix, facilitating the job that needs to be done right now. Because they offer a solution, people are largely happy to let them go unchecked.

In a business environment where this is a common occurrence, control is drifting. These unofficial stop-gaps pile up, with each placing an obstacle between the status quo and bona fide compliance.

3. The heat: moments of pressure

Once you’ve got enough sticking plaster solutions to prevent you from completing a comprehensive audit, and an environment where this is accepted as the norm, all you are waiting for is a moment of pressure to ignite the fire.

From business audits and compliance reviews to mergers and acquisitions, pressure scenarios that departments or the business does not control can see an important moment go up in smoke. Failure to produce the vital figures, or a demonstrable lack of reporting quality/consistency, can be the death knell for opportunity or success.

These moments are allowed to ‘surprise us’ based on the assumption that someone, somewhere, will improve it – after all, research suggests that 97% of financial service organisations are undergoing some sort of large-scale digital transformation.

But these processes take years, and risk failing to identify the processes that represent a fire hazard in the first place. Organisations need to be able to act in weeks, not years, if they are to effectively douse the embers of legitimate and dangerous threats to their internal operations.