The situation

A large, international insurance firm with branches across the world could see that they had a problem collecting payments in a timely manner.

- Invoices issued by local offices through a global system

- Payments tracked centrally and reconciled with related invoices

- Outstanding invoices information held in central finance system

- Local credit controllers using periodic reports from finance system to chase payment

The problem

With the data ‘locked away’ in the central finance system and only intermittently distributed via spreadsheet to the people responsible for debt recovery in each branch, there was a disjoin between the Business Information and the operational actions.

Also, with a one-way communication of the data out of finance to the branches, the resolution of outstanding debts was only recognised as payments came in, with no clear understanding of the range and effectiveness of actions taken.

Providing direct access to the central finance system to branch-level credit controllers was not an option both for reasons of security and cost (i.e. adding hundreds of licenses to the system for this single task).

The solution

LiveDataset’s Debtor Management application provided the client with a secure, frictionless way to extract and share the financial data with the branches, with access limited by location, job role and seniority.

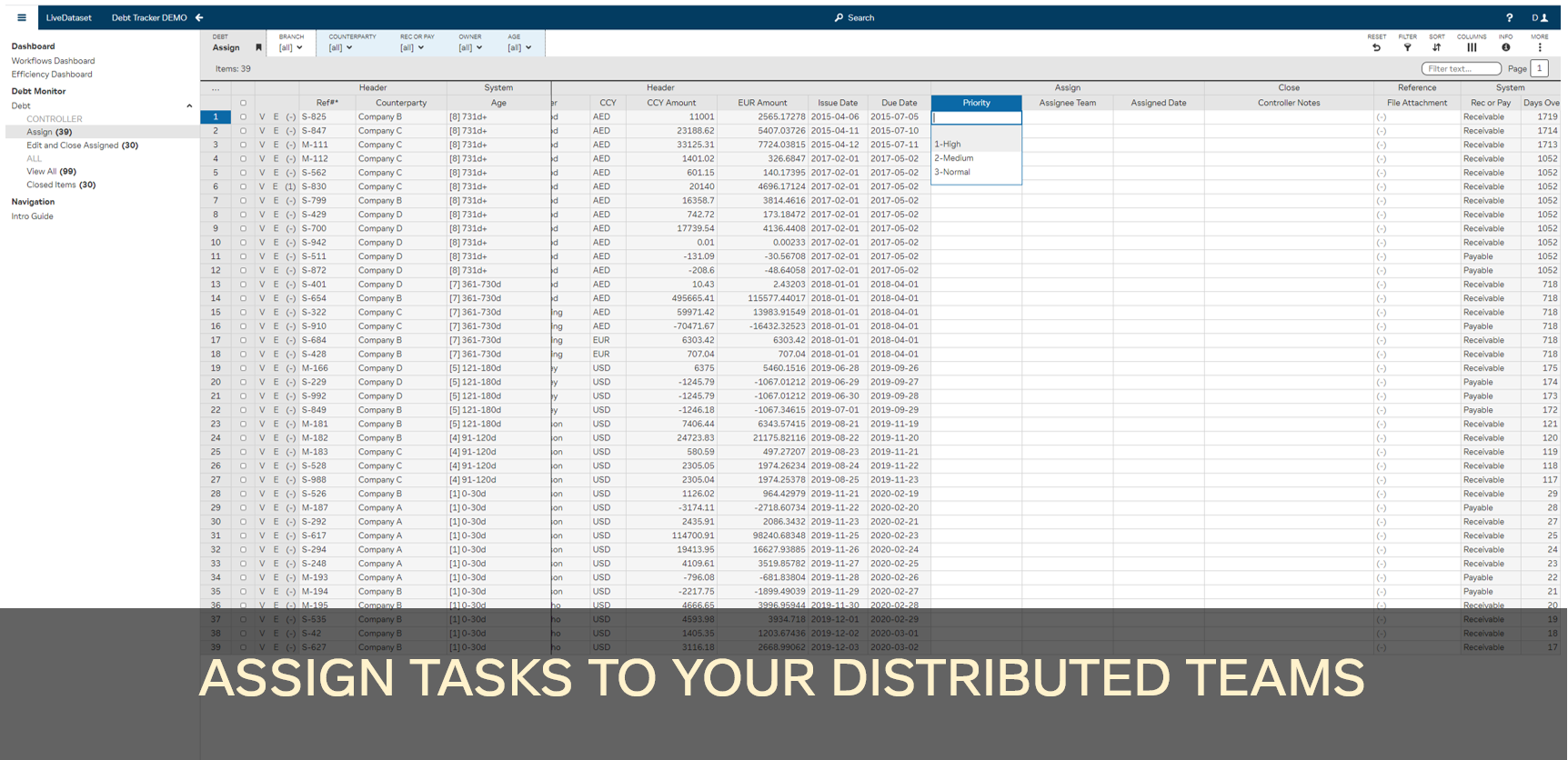

Understanding what data needed to be shared, and with whom, we were able to quickly configure the workflows that allowed local credit controllers to delegate the actions on each account to the teams responsible for recovering the debt.

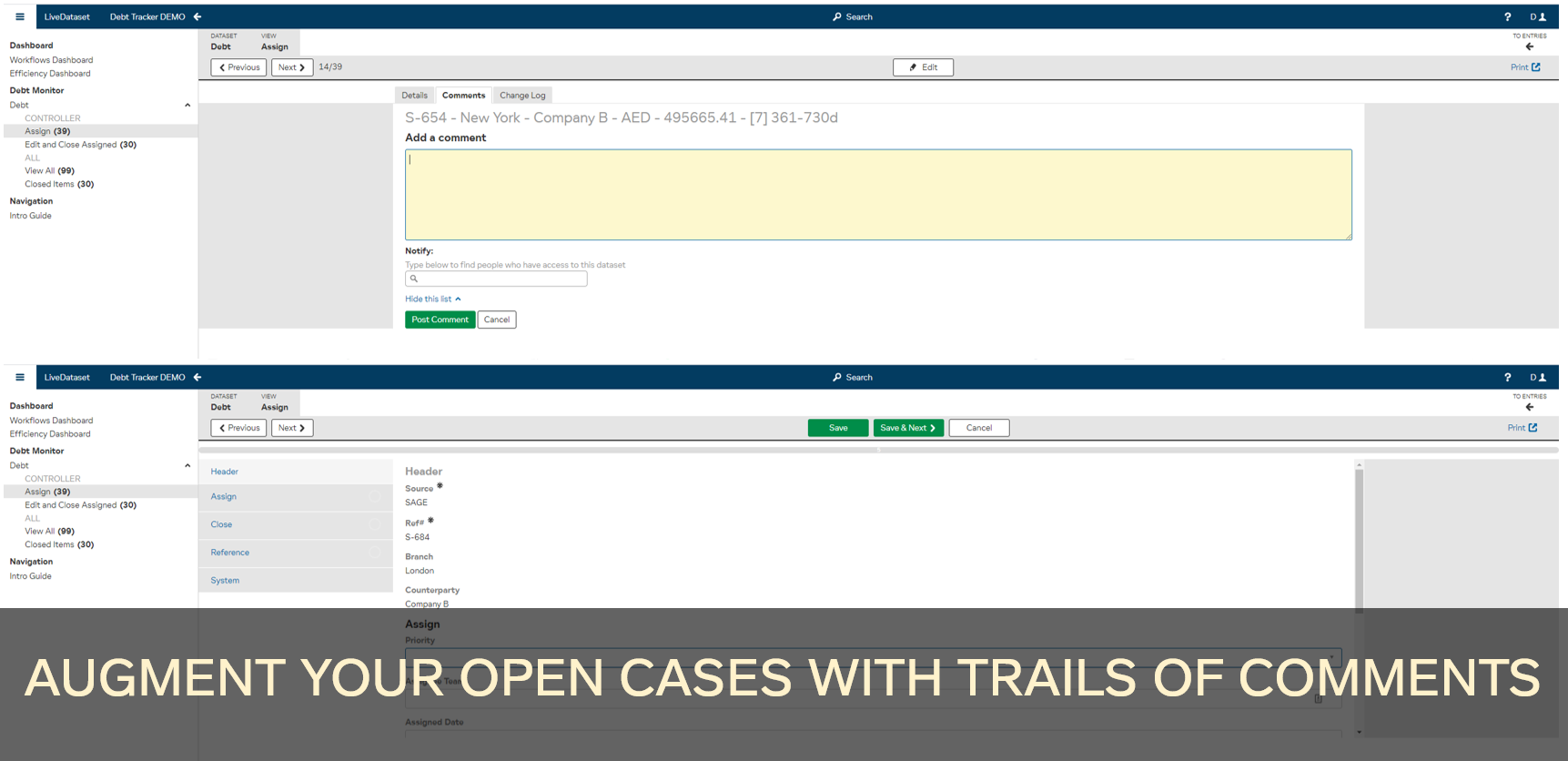

Crucially, because LiveDataset allows you to augment the core data being fed from other systems, the individual managers could categorise the debts, provide accurate statuses and add commentary to provide an accurate, real-time view of actions taken on the outstanding.

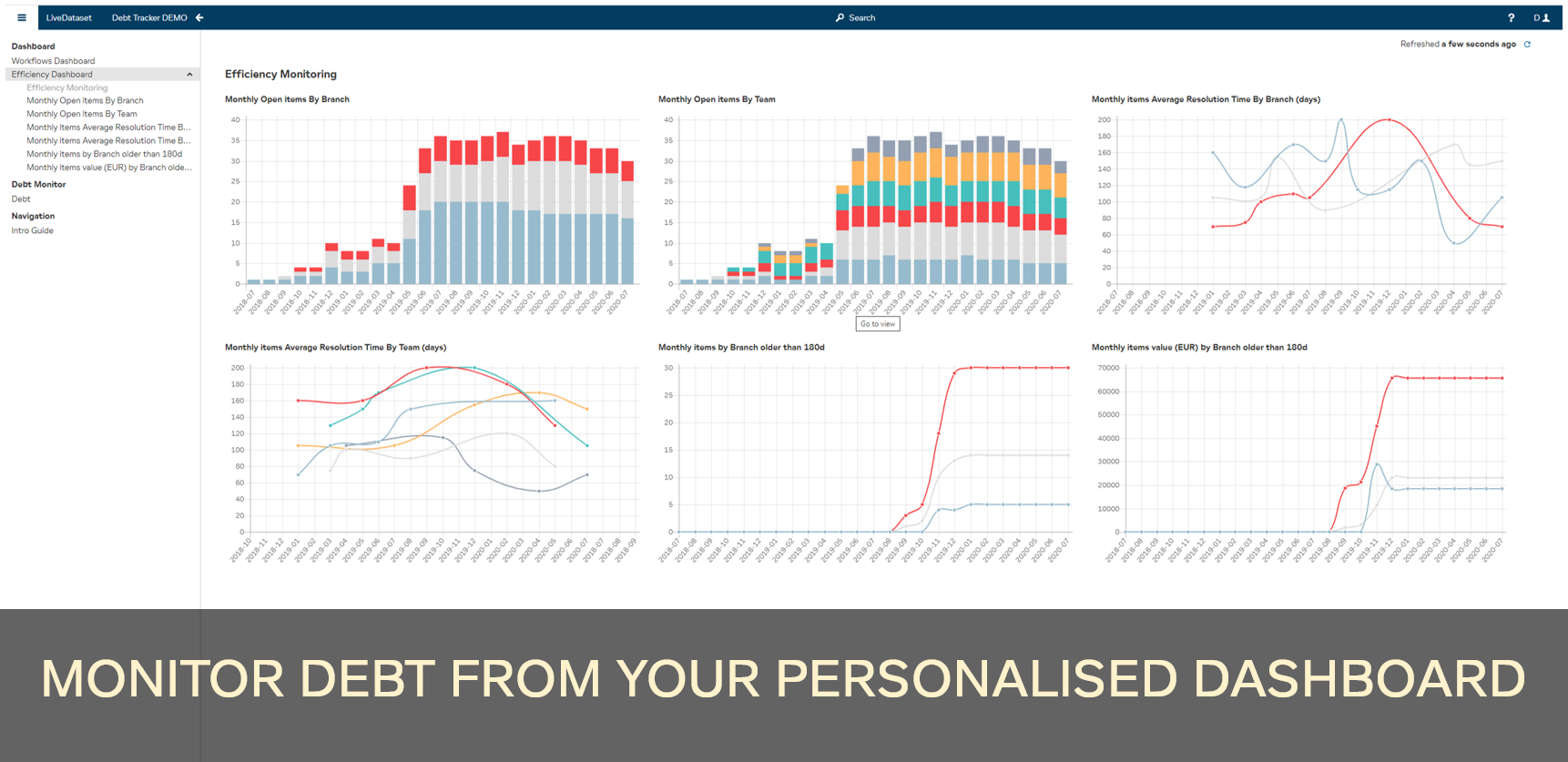

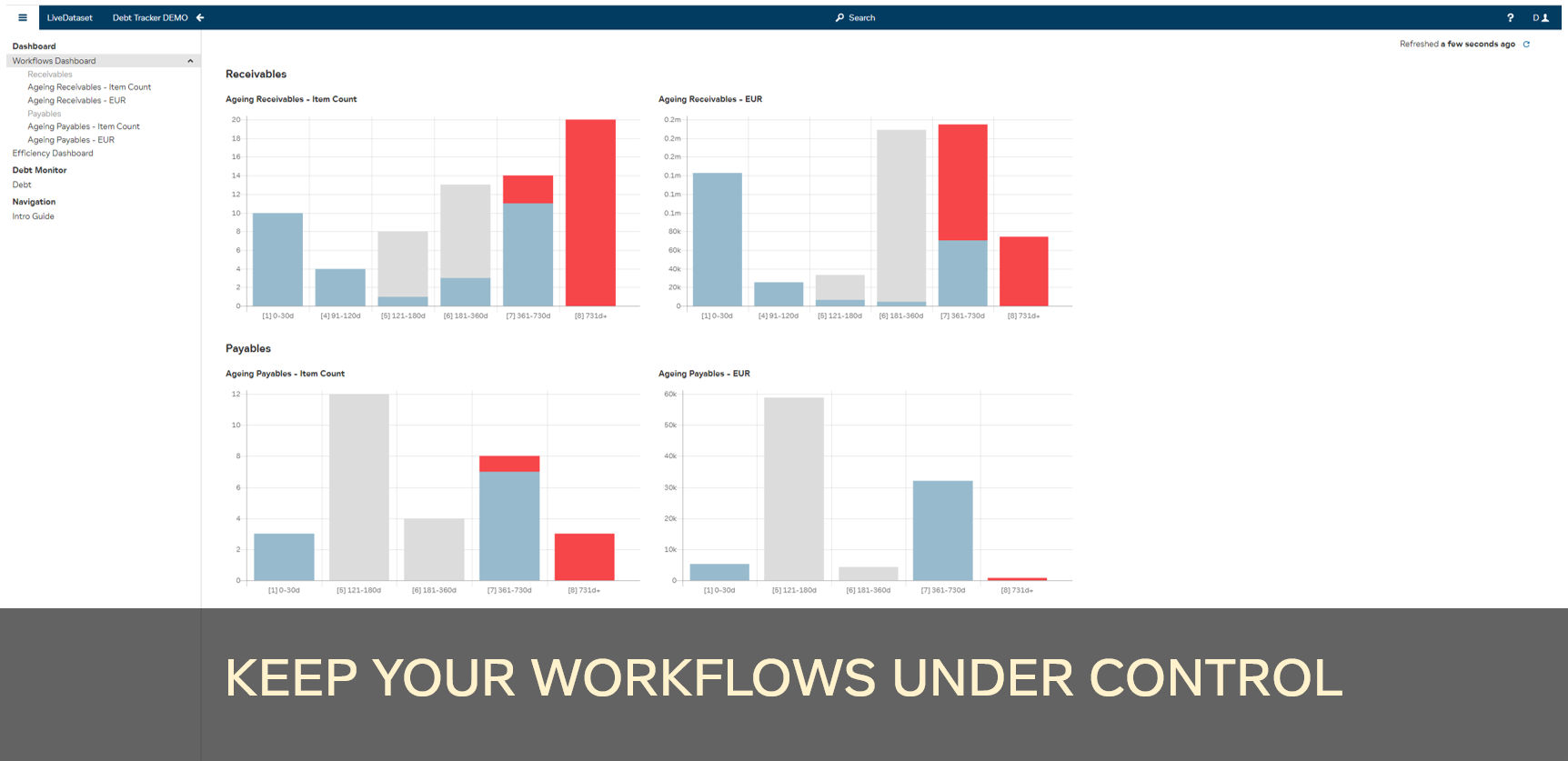

Finally, with integrated charting and visualization functionality we were able to configure custom dashboards that allowed everyone, whether at a branch, national or global level to see at a glance the debtors status and track weekly and monthly efficiency in closing open positions.

The outcome

Nothing is more rewarding than receiving appreciation for your work directly from your clients’ words:

“The collaboration with LiveDataset has been a success from the start – combined with the capabilities of their implementation team we deployed a global data workflow and collaboration tool within weeks, and iteratively developed and expanded the solution to what it is today: better data collaboration across various functions globally, based on a single source of truth, in a structured manner. Working with the LiveDataset team is characterized by high flexibility, quick and thorough understanding of our business challenges, and proactivity in developing further improvements to our solution”.

The application was configured and fully operational within 6 weeks, complete with automated feeds from the central finance software. With an initial roll-out to a small number of branches the client was able to quickly see the impact of transparency and immediacy in their operational data. For example, higher performing branches could be identified, and their processes shared with the lower performing ones to generally improve the speed of collection. Moreover, the ‘return path’ of augmented data from the field gave the central finance team a much more detailed story around the outstanding debt allowing them to more accurately predict cashflow.

Over the next year, the application and workflow was rolled-out globally, with operational metrics that created an unprecedented level of awareness to both central and local management – a powerful lever to identify and promote best practices and drive efficiency improvements.